ANML Token Value Calculator

Calculate Your ANML Value

Price Information

Current price: $0.00002 (as of October 2025)

All-time high: $0.03043 (April 2022)

Projected 2026 price: $0.00003 - $0.00004

Current Value

$0.00

All-time high value

$0.00

Quick Takeaways

- ANML is an ERC‑20 utility token for the Animal Concerts metaverse platform.

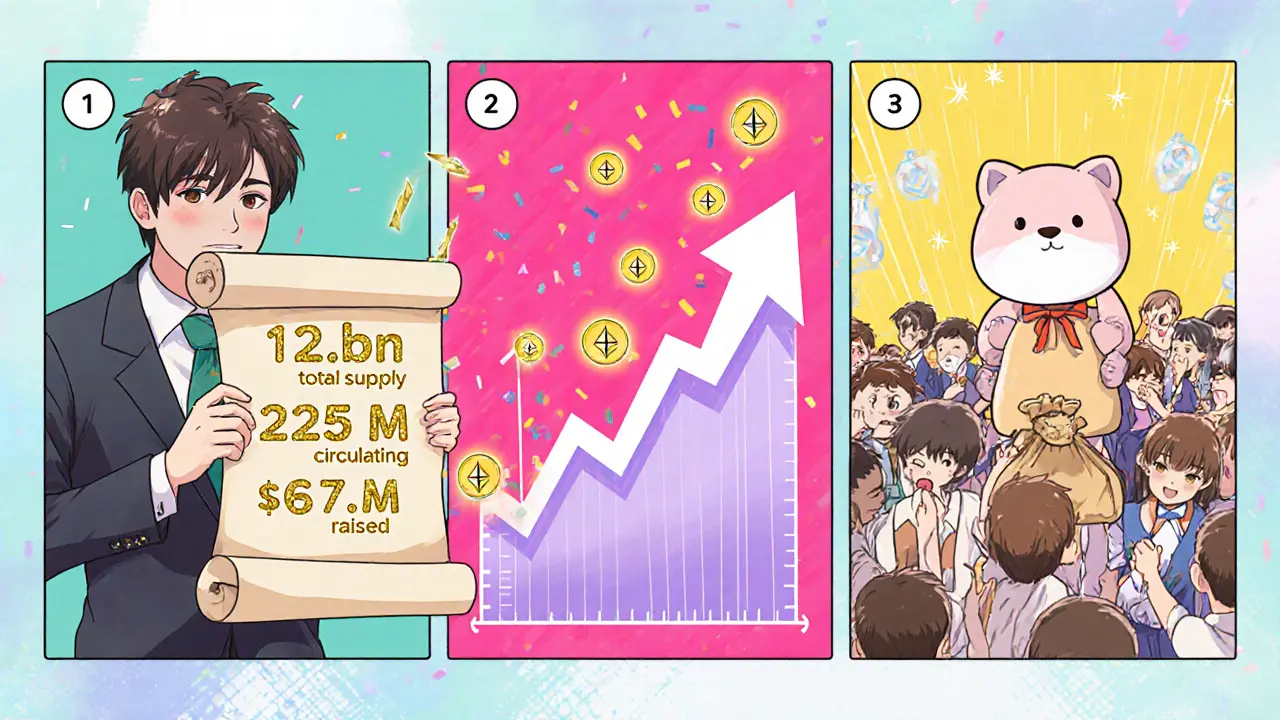

- Launched early 2022, it raised about $6.75 million across private and public sales.

- All‑time high peaked at $0.03043 (CoinGecko) in 2022; current price hovers below $0.00002.

- Tokenomics: 12.5 billion total supply, ~1.8 % circulating.

- Utility includes payments, NFT access, staking rewards and governance.

When you first hear about Animal Concerts (ANML) is a cryptocurrency token built to power a metaverse‑focused live‑music platform. The project describes itself as “building the next generation of live events in the metaverse,” aiming to blend physical concerts, NFT drops, and virtual streaming under one blockchain‑backed ecosystem.

What the ANML token actually is

The ANML token lives on the ERC‑20 standard, which means it can be stored in any Ethereum‑compatible wallet and traded on DEXs like PancakeSwap and ApeSwap. Its primary role is as a utility token: fans pay with ANML for virtual tickets, artists receive royalties, and holders can stake the token to earn a share of platform revenues.

Fundraising timeline and how much was raised

Animal Concerts ran several rounds in early 2022:

- Private 2 Round (Feb 23‑24 2022): $50,000 at $0.0035 per token.

- Public Round (Feb 24‑25 2022): $844,000 at $0.0045 per token.

- Additional IDO rounds in January 2022 raised a combined $580,000.

Aggregating all rounds, the project pulled in roughly $6.75 million, according to data aggregators.

Tokenomics - supply, distribution, and circulating amount

Total supply is fixed at 12.5 billion ANML. Only about 225 million tokens (≈1.8 %) are in circulation, leaving most of the supply locked in various vesting schedules for private investors, the team, and ecosystem reserves.

Key allocation percentages (rounded):

- Private/Pre‑sale: 17.5 % (≈2.19 bn)

- Public sale: 3.33 % (≈416 m)

- Team & advisors: < 1 % with cliffs and linear releases

- Reserve & ecosystem funds: remaining tokens, released gradually.

Price performance and market data

ANML’s price story is a classic boom‑bust curve. CoinGecko records an all‑time high of $0.03043 on 5 April 2022. Some trackers (CoinPaprika) cite a later high of $0.001449 on 4 January 2024, reflecting data inconsistencies across platforms. As of October 2025, the token trades between $0.000015 and $0.000074, a drop of over 99 % from its peak.

Market‑cap rank hovers around 7,500, with a 24‑hour volume under $100 k, indicating low liquidity. Fully diluted valuation (FDV) estimates vary wildly: RootData lists about $925 k, while Cryptorank once quoted a $56 million FDV at launch.

Utility inside the Animal Concerts ecosystem

The platform promises several use cases for ANML:

- Payments: Buy tickets for virtual and real‑world concerts.

- NFT access: Unlock exclusive digital collectibles tied to artists.

- Staking rewards: Lock ANML to earn a share of transaction fees.

- Governance: Token holders can vote on platform upgrades and event curation.

Despite these declared utilities, on‑ground adoption remains thin. Trading volume is low, and there is little public data on actual concert ticket sales executed via ANML.

Where you can trade ANML today

ANML is listed on a handful of exchanges:

- Gate.io (ANML/USDT pair)

- ApeSwap (BNB‑based DEX)

- PancakeSwap V2 (BSC bridge)

Low liquidity means large orders can cause noticeable price slippage, a risk for traders looking to move sizable amounts.

Risks and future outlook

Three major risk factors dominate the ANML narrative:

- Market adoption: The metaverse and NFT hype has cooled dramatically since 2021‑2022. Competing projects like The Sandbox (SAND) and Decentraland (MANA) retain far larger user bases.

- Liquidity crunch: With daily volume < $100 k, exiting positions can be costly.

- Development progress: Public updates are sparse. Without clear milestones-such as confirmed live‑artist partnerships-community confidence wanes.

Price‑prediction models (Swapspace, TradingBeast) only see modest upside, projecting $0.00003‑$0.00004 by 2026, which is still a tiny fraction of historic peaks.

How ANML stacks up against other metaverse tokens

| Metric | ANML | SAND (The Sandbox) | MANA (Decentraland) |

|---|---|---|---|

| Launch year | 2022 | 2020 | 2017 |

| Total supply | 12.5 bn | 1 bn | 10 bn |

| Current price (USD) | $0.00002 (≈) | $0.35 | $0.45 |

| 24‑h volume | < $100 k | $200 M+ | $180 M+ |

| Market‑cap rank | ~7,500 | #200 | #150 |

| Core use case | Live‑music metaverse | Virtual land & games | Virtual land & social |

The table makes it clear that ANML operates in a niche corner of the metaverse market, with far smaller liquidity and user adoption than the broader virtual‑world tokens.

Getting started - a quick checklist

- Set up an ERC‑20 compatible wallet (MetaMask, Trust Wallet).

- Buy a modest amount of ANML on Gate.io or PancakeSwap.

- Stake the token on the official Animal Concerts portal (if staking is live).

- Follow official channels for upcoming concert drops and governance votes.

Remember: only invest what you can afford to lose, especially with low‑liquidity assets.

What blockchain does ANML run on?

ANML is an ERC‑20 token on the Ethereum network, which means it can be stored in any Ethereum‑compatible wallet and moved via standard Ethereum transactions.

How can I use ANML in the Animal Concerts platform?

The token is used to purchase tickets for virtual concerts, unlock exclusive NFTs, stake for rewards, and vote on platform decisions.

Is ANML a good investment right now?

Investment suitability depends on risk tolerance. The token’s price has fallen over 99 % from its peak, liquidity is low, and adoption is limited. Treat it as a high‑risk speculative asset.

Where can I trade ANML?

ANML is listed on Gate.io, ApeSwap, and PancakeSwap. Because volumes are thin, expect higher slippage on larger trades.

What are the main risks associated with ANML?

Key risks include minimal market adoption, low liquidity, and uncertain development progress. The broader metaverse market has cooled, which may limit growth.

harrison houghton

October 21, 2025 AT 08:33they raised $6.75 million and turned it into digital confetti.

the only thing more dead than this token is the metaverse hype that birthed it.

you don't need a blockchain to stream a concert. you need wifi and a decent speaker.

they're not building the future. they're burying their own investors in slow motion.

if you're holding ANML hoping for a comeback, you're not an investor. you're a volunteer at a funeral.

DINESH YADAV

October 21, 2025 AT 16:56rachel terry

October 22, 2025 AT 07:5712.5 billion supply and 1.8% circulating? that's not a token it's a pyramid with a logo

and the fact that they're still pretending this is 'utility' when no one's buying tickets with it? darling this isn't web3 this is web3 theater

Susan Bari

October 23, 2025 AT 07:23next they'll tokenize my cat's meow.

at least when the dot-com bubble burst people didn't pretend their websites were cultural revolutions.

we're not living in the future. we're living in the punchline.

Sean Hawkins

October 23, 2025 AT 23:54Marlie Ledesma

October 24, 2025 AT 13:12Daisy Family

October 25, 2025 AT 04:35Paul Kotze

October 25, 2025 AT 23:22Jason Roland

October 26, 2025 AT 11:48Niki Burandt

October 26, 2025 AT 21:45low volume? 🤡

no real adoption? 🤡

still holding? 🤡

you're not an investor... you're the punchline. 🐸💸