Every day, new cryptocurrency projects promise life-changing returns. Some are real. Most aren’t. The most common way investors lose everything isn’t through market crashes-it’s through rug pulls. These aren’t glitches or bad bets. They’re carefully planned thefts disguised as opportunities. And they’ve cost investors billions.

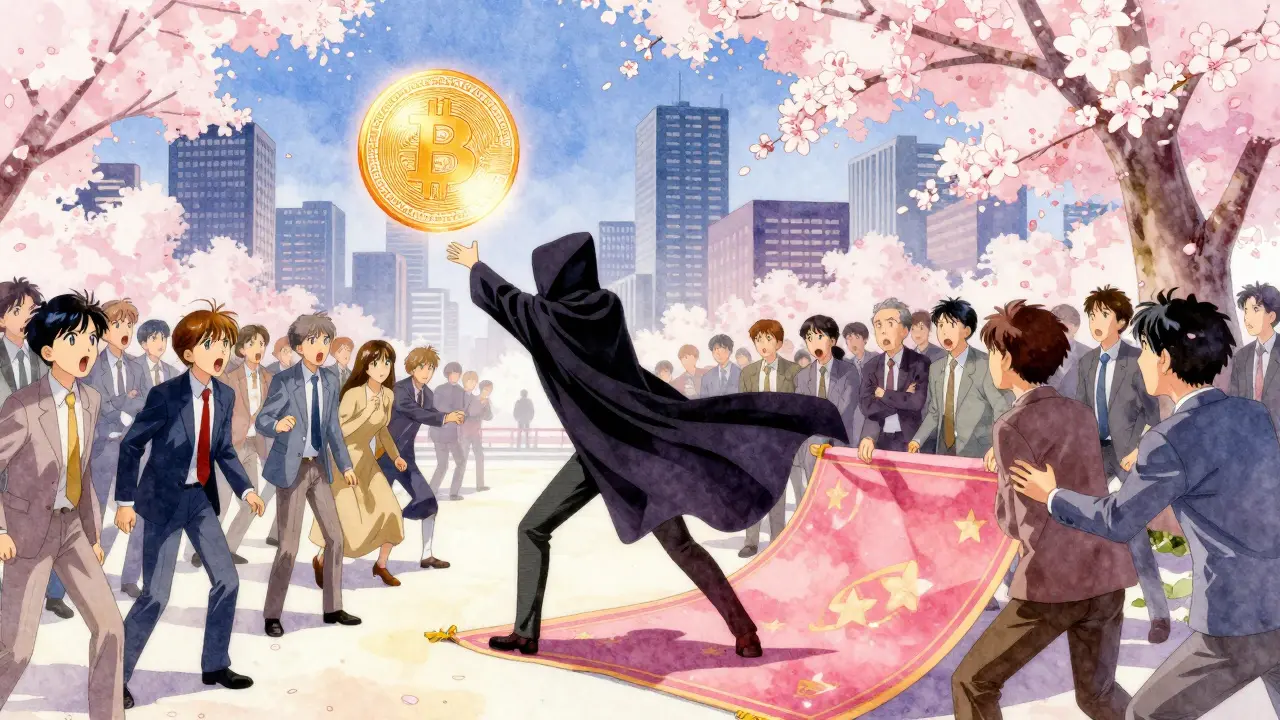

What Exactly Is a Rug Pull?

A rug pull happens when developers create a cryptocurrency, hype it up, get people to invest, and then vanish with the money. The name comes from the image of someone yanking out a rug-suddenly, there’s nothing left under your feet. These scams usually follow two paths: DeFi scams, where the smart contract is rigged to lock your funds or let the devs drain liquidity, and exit scams, where the team promotes the token aggressively, then disappears without a trace. Unlike failed projects that simply don’t deliver, rug pulls are designed from the start to steal. The scammers don’t care if the tech works. They care about one thing: getting your money out before you can sell.Thodex: The $2 Billion Exchange Heist

In April 2021, Thodex, a Turkish cryptocurrency exchange with over 2 million users, suddenly shut down. Its founder, Faruk Fatih Özer, vanished. Withdrawals stopped. Emails went unanswered. Within days, investigators found that over $2 billion in crypto had been drained from user accounts. Thodex wasn’t a DeFi project. It was a centralized exchange-something people trusted like a bank. That’s what made it so dangerous. Users weren’t buying obscure tokens; they were depositing Bitcoin, Ethereum, and other major coins, believing their funds were safe. The collapse wiped out nearly 90% of all rug pull losses in 2021. It proved that even big, seemingly legitimate platforms can be fronts for fraud.AnubisDAO: A $60 Million Overnight Scam

On October 28, 2021, AnubisDAO launched with a DOGE-style logo, no website, no whitepaper, and developers hiding behind pseudonyms. Within hours, it raised nearly $60 million in wrapped Ethereum (wETH) from investors eager for a decentralized currency backed by a basket of assets. The promise? Stability. The reality? A trap. Within 20 hours, the liquidity pool vanished. Every single dollar of investor funds-over $58 million-was pulled out and converted into ETH. The token, ANKH, dropped to zero. No one could sell. No one could trace the devs. The whole thing was built on pure deception, with zero infrastructure beyond a token contract and a Discord server. It’s a textbook example of how little it takes to steal millions in crypto.Squid Game Token: When Pop Culture Becomes a Trap

In November 2021, Netflix’s hit show Squid Game was everywhere. Scammers saw an opening. They launched a token called SQUID, claiming it was a play-to-earn game tied to the show. The token jumped from $0.01 to $2,861 in less than a week. Investors rushed in, thinking they’d found the next Dogecoin. Then, the rug was pulled. The website went dark. The Discord and Telegram groups vanished. The whitepaper-filled with impossible claims like “10x returns in 48 hours”-was revealed to be a copy-paste job with no technical details. The developers had sold their entire supply, pocketing over $3.38 million. The token crashed 99% in a single day. It wasn’t just a scam. It was a cultural manipulation. People invested because they loved the show, not because they understood blockchain.

Bored Bunny NFT: Fake Celebrities, Fake Value

In December 2021, Bored Bunny NFTs exploded. The project claimed to have endorsements from Floyd Mayweather, Jake Paul, and David Dobrik. It sold out in hours, raising 2,000 ETH-worth over $7 million at the time. Buyers thought they were getting rare digital art with future utility: merchandise, a metaverse, and celebrity backing. But the endorsements were fake. Blockchain sleuths found the NFTs supposedly owned by celebrities were actually held by wallets linked to the project’s developers. The “exclusive” collection had no artistic merit. The metaverse never materialized. Within months, the floor price dropped from over 1 ETH to just 0.085 ETH. Investors lost millions. The scam worked because it looked real-until it didn’t.Froggy (FROGGY): The 2024 Meme Token Trap

Early 2024 saw the rise of FROGGY, a meme coin promoted heavily on X (Twitter) and Reddit. The branding was funny. The team claimed to be “community-driven.” They even created memes and giveaways to build hype. Investors jumped in, seeing early gains and believing the project had momentum. But the smart contract was rigged. Liquidity was locked in a way that only the devs could remove it. Once enough money flowed in, they drained the pool. The token, which once peaked at $0.00001577, now trades at $0.0000000073964-a 99.95% drop. The devs vanished. The community was left with digital trash. This wasn’t a new tactic. It was the same old scam, repackaged for a new generation of crypto newcomers.Hawk Tuah (HAWK): A Celebrity-Backed Collapse

On December 4, 2024, TikTok influencer Hailey Welch launched HAWK, a meme coin tied to her viral phrase “hawk tuah.” Within 20 minutes, the market cap crashed from $500 million to $60 million. The token, which briefly hit $0.0022413, fell to $0.0006404-a 71% drop in hours. The backlash was immediate. U.S. law firm Burwick Law filed a federal lawsuit against Welch and three others behind the project. Regulators took notice. This wasn’t just another meme coin. It was a celebrity-driven fraud. People trusted Welch because they saw her online. They didn’t check the contract. They didn’t verify liquidity. They believed her.

How Rug Pulls Are Built to Fail

These scams don’t rely on luck. They’re engineered. Here’s how:- Honeypot contracts: The smart contract looks like you can sell your tokens-but you can’t. It’s a trap.

- Unlimited minting: The devs can create more tokens anytime, flooding the market and crashing the price.

- High trading fees: 10%, 20%, even 50% fees on sales make it impossible to exit.

- Fake partnerships: Press releases with fake companies, fake influencers, fake audits.

- Wash trading: Bots buy and sell the token to create fake volume and momentum.

How to Spot a Rug Pull Before It’s Too Late

You don’t need to be a coder to protect yourself. Here’s what to check:- Is the team anonymous? Real projects have identifiable founders with LinkedIn profiles and public track records.

- Is the liquidity locked? Use tools like DexScreener or RugCheck to see if liquidity is locked for months. If it’s not, run.

- Is there a whitepaper? If it’s just a one-page PDF with buzzwords and no technical details, it’s a red flag.

- Are there audits? A reputable audit from CertiK or PeckShield isn’t a guarantee-but the absence is a warning.

- Does the project have real utility? Is it solving a problem? Or is it just a meme with a token?

Why Rug Pulls Keep Winning

Over 300,000 scam tokens have been created since 2020. Two million people have lost money. Why do these scams keep working? Because they target emotion, not logic. Fear of missing out. Greed. Trust in influencers. The belief that “this time is different.” Regulators are catching up. Lawsuits like the one against Hawk Tuah are becoming more common. But blockchain is global. Developers operate from countries with no extradition. Wallets are anonymous. Recovery is nearly impossible. The only real defense is awareness. Every investor who loses money to a rug pull isn’t just out cash-they’re out trust. And trust is the one thing crypto can’t afford to lose.What Happens After a Rug Pull?

Once the liquidity is gone, the token is dead. There’s no recovery. No refunds. No government bailout. The blockchain doesn’t reverse transactions. The money is gone forever. Some communities try to rebuild. They fork the token. They create a new version. But the original investors? They’re left with nothing. The new token? It’s often just another scam in disguise. The only winners are the scammers-and sometimes, the early buyers who cashed out before the crash. That’s the brutal truth of rug pulls. It’s not a market. It’s a casino where the house always wins.Can you recover money lost in a rug pull?

Almost never. Once liquidity is drained and tokens crash, the funds are permanently moved to wallets controlled by the scammers. Blockchain transactions are irreversible. While lawsuits (like the one against Hawk Tuah) can target the people behind the scam, recovering actual crypto is extremely rare. Most victims never see their money again.

Are all meme coins rug pulls?

No. Many meme coins like Dogecoin and Shiba Inu were created as jokes and grew organically with real communities. But most new meme coins launched today are rug pulls. The difference is in transparency: real meme coins have open teams, locked liquidity, and no promises of returns. Fake ones rely on hype, anonymity, and exit strategies.

How do I check if a token’s liquidity is locked?

Use tools like DexScreener, RugCheck, or TokenSniffer. Enter the token’s contract address. Look for a “Locked Liquidity” badge or a lock period (e.g., “Liquidity locked for 1 year”). If it says “Unlocked” or shows no lock at all, don’t invest. Also, check who holds the liquidity-real projects use multi-sig wallets, not single developer addresses.

Can smart contract audits prevent rug pulls?

Audits help, but they’re not foolproof. Many audits only check for basic bugs, not malicious code like honeypots or minting functions. A project can pass an audit and still be a rug pull. Always look for audits from reputable firms like CertiK or PeckShield, and never rely on audits alone. Combine them with team verification and liquidity checks.

Why do celebrities get involved in rug pulls?

They’re paid-often millions-to promote a token they don’t understand. Many don’t know the project is a scam until after it’s launched. Others are complicit. Either way, their involvement gives the scam credibility. The Hawk Tuah case showed how powerful celebrity influence can be-and how dangerous it is when used to sell unverified crypto.