Crypto Exchange Risk Assessment Tool

Evaluate Your Crypto Risk

This tool assesses the risk level of using unregulated exchanges like FMCPAY compared to regulated platforms. Based on your investment amount, risk tolerance, and crypto activity.

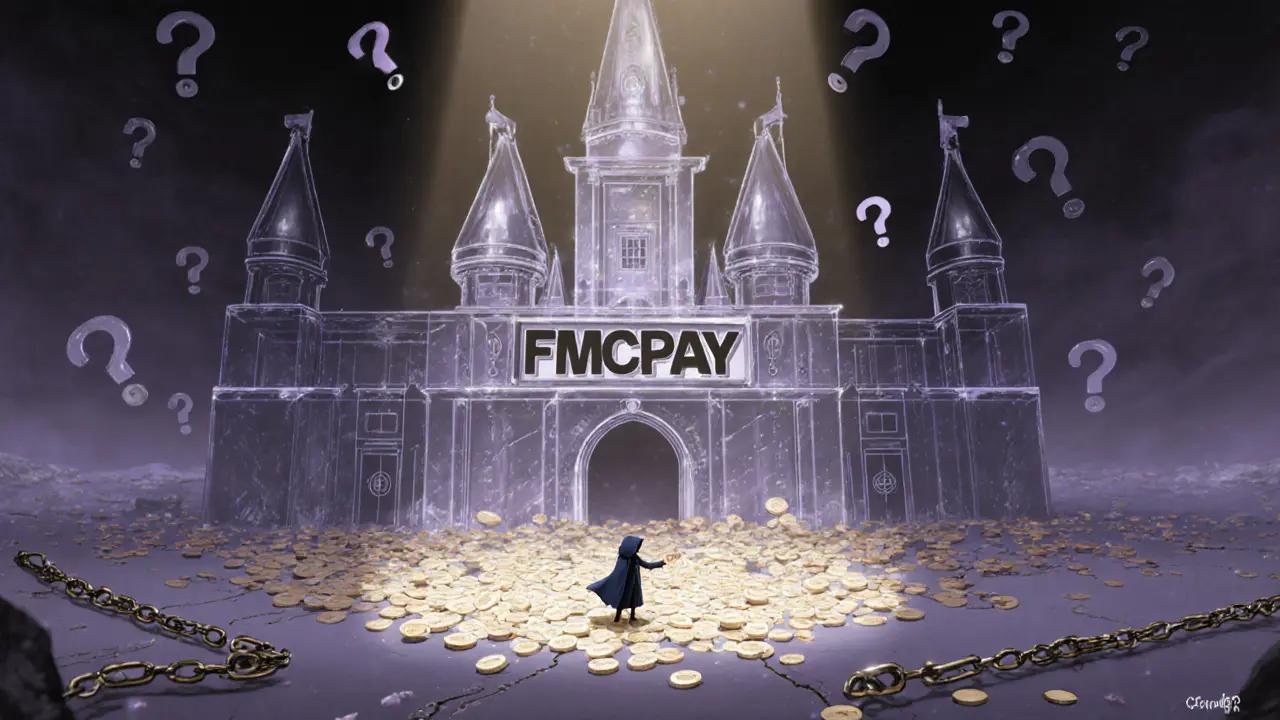

If you're looking at FMCPAY as a place to trade crypto, you need to know one thing upfront: it’s not regulated by any major financial authority. That’s not a small detail-it’s the biggest red flag in this whole story.

What Is FMCPAY?

FMCPAY is a cryptocurrency exchange that launched in 2021. It lets users trade over 30 coins, including Bitcoin, Ethereum, and Litecoin. It also offers staking and peer-to-peer (P2P) trading, which sounds useful if you want to buy crypto directly from other users without going through a bank. It claims to have 2 million users across 65 countries as of late 2024. That sounds impressive-until you check the numbers. CoinMarketCap lists FMCPAY as “untracked.” That means they don’t have enough verified trading volume to be included in standard market data. If a platform can’t prove how much crypto is actually moving through it, why should you trust it?Security: Sounds Good, But No Proof

FMCPAY says it uses encryption and multi-factor authentication (MFA). That’s standard. But here’s the problem: they never say what kind. Is it AES-256 encryption? Are you using Google Authenticator, SMS, or a hardware key? No details. That’s like saying your car has “brakes” but refusing to tell me if they’re disc or drum, or if they’ve been inspected this year. They also mention a “client protection fund.” Sounds reassuring, right? Except no one knows how big it is, how it’s funded, or if it’s even real. Compare that to Binance or Coinbase, which publish regular proof-of-reserves audits. FMCPAY doesn’t. And in crypto, if you can’t prove you hold the assets you claim to, you’re just asking for trouble.Regulation: The Dealbreaker

This is where FMCPAY falls apart. BrokerChooser, a trusted brokerage verification service, explicitly states: “We wouldn’t trust FMCPAY with our own money as it is not regulated by a financial authority with strict standards.” What does that mean for you? If something goes wrong-your funds get frozen, the site goes down, or worse, it turns out to be a scam-you have almost no legal recourse. No government agency will step in to help you. No ombudsman. No insurance fund. No path to get your money back. Compare that to platforms like Coinbase, which is regulated by the SEC and FinCEN in the U.S., or Kraken, licensed by the NYDFS. If you lose money there, you have rights. With FMCPAY? You’re on your own.

Trustpilot vs. Reality

Some sources say FMCPAY has a 4.4-star rating on Trustpilot. That sounds great. But here’s the catch: Forex Peace Army, another trusted review platform, reported in November 2024 that FMCPAY had zero reviews and was “not yet rated.” Which one’s right? Hard to say. The contradiction suggests either the data is unreliable, or reviews are being manipulated. Either way, if a platform’s reputation is this inconsistent across trusted sources, that’s a warning sign.Who Is FMCPAY For?

If you live in a country where regulated exchanges are blocked or hard to access-maybe due to banking restrictions or government controls-FMCPAY might seem like the only option. It’s easy to sign up, supports P2P trading, and works on mobile. For someone who just wants to buy a little BTC and doesn’t care about long-term safety, it might feel convenient. But if you’re serious about crypto-if you’re holding more than a few hundred dollars, planning to stake, or thinking long-term-this isn’t the place. The lack of regulation, transparency, and accountability makes it a high-risk gamble.

Alternatives That Actually Protect You

There are better options out there. You don’t have to settle for unregulated platforms.- Coinbase: Regulated in the U.S., insured custodial wallets, easy for beginners.

- Kraken: Strong security, transparent reserves, licensed in multiple jurisdictions.

- Binance: Largest volume globally, though facing regulatory scrutiny in some regions.

- Interactive Brokers: If you want to trade crypto alongside stocks and ETFs under SEC and FCA oversight.

Final Verdict: Avoid Unless You’re Willing to Lose It All

FMCPAY isn’t a scam in the classic sense. It’s not a Ponzi. It’s not obviously fake. But it’s built on a foundation of silence. No regulation. No transparency. No accountability. The fact that it’s listed on CoinMarketCap doesn’t mean it’s safe-it just means they met the bare minimum technical requirement to appear. Think of it like a restaurant with a health inspection sticker… but no one’s ever seen the kitchen. If you’re new to crypto and want to learn, start with a regulated exchange. If you’re holding real money, don’t risk it on a platform that won’t tell you how it protects you. FMCPAY might look tempting-but in crypto, the safest choice is almost always the one that plays by the rules.Is FMCPAY regulated?

No, FMCPAY is not regulated by any top-tier financial authority like the SEC, FCA, or ASIC. BrokerChooser and other verification services explicitly state it lacks regulatory oversight, which means users have little to no legal protection if something goes wrong.

Can I trust FMCPAY with my crypto?

If you’re holding a small amount for testing purposes, you might take the risk. But if you’re storing significant value, the answer is no. FMCPAY doesn’t publish proof of reserves, lacks regulatory backing, and offers no clear path for recovery if funds are lost or stolen. Regulated exchanges like Coinbase or Kraken are far safer.

Does FMCPAY have a mobile app?

FMCPAY claims to support mobile access, but there’s no official confirmation of a dedicated app on Apple’s App Store or Google Play. The platform appears to be accessible via web browser on mobile devices, but without a verified app, you risk phishing sites or fake downloads.

Why is FMCPAY untracked on CoinMarketCap?

CoinMarketCap only tracks exchanges with verifiable trading volume and liquidity data. FMCPAY’s volume is untracked because it hasn’t provided audited or third-party-verified data. This doesn’t mean it’s inactive-it means its activity can’t be confirmed, which raises red flags about transparency.

What’s the difference between FMCPAY and Binance or Coinbase?

Binance and Coinbase are regulated, publish regular proof-of-reserves audits, and are licensed in multiple countries. They have legal obligations to protect users. FMCPAY does none of this. It offers similar features-trading, staking, P2P-but without the safety nets. You’re trading convenience for risk.

Can I withdraw my funds from FMCPAY?

According to user reports and platform claims, withdrawals are possible. But there’s no public data on withdrawal times, fees, or success rates. Without regulation, there’s no guarantee that withdrawals will remain reliable. If the platform changes its policies or shuts down, you may not get your funds back.

Is FMCPAY a scam?

It’s not proven to be a scam, but it operates in a gray zone with zero regulatory oversight. Many legitimate platforms have failed without regulation because they lacked transparency. FMCPAY’s lack of audited data, inconsistent reviews, and absence of official licensing make it a high-risk platform. Treat it like a gamble, not an investment.