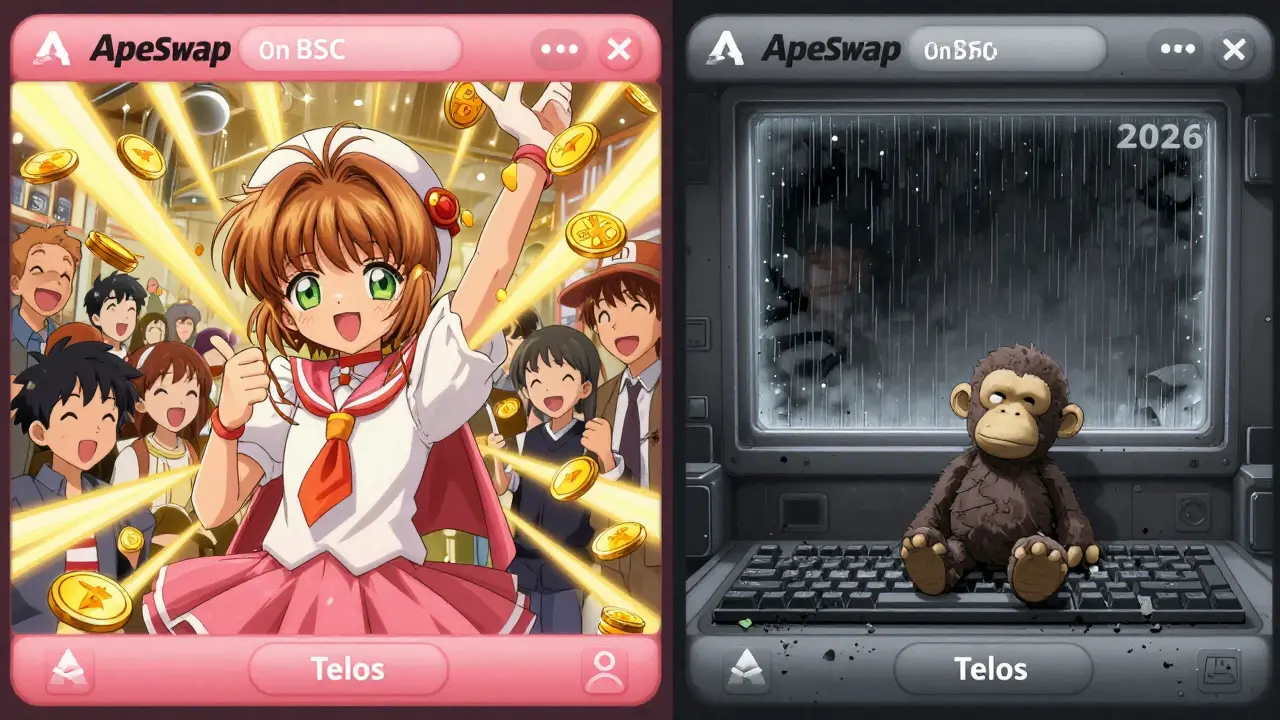

When you hear "ApeSwap," you probably think of high-yield farms, low fees, and a fun ape-themed interface. That’s true - but only on Binance Smart Chain. On Telos, ApeSwap is a ghost town.

Launched in October 2022, ApeSwap’s Telos version promised to bring its popular DeFi tools - swapping, staking, yield farming, and Treasury Bills - to a fast, cheap blockchain. It had the tech. It had the token (BANANA). It even had a revenue-sharing deal with the Telos team. But today, in January 2026, the 24-hour trading volume on ApeSwap (Telos) is $0.00. Zero. Not $50. Not $5. Zero.

This isn’t a glitch. It’s a reality check.

What ApeSwap on Telos Actually Offers

ApeSwap on Telos isn’t broken. It’s just unused. The platform still works. You can connect your Web3 wallet - like Rabby or MathWallet - and swap tokens. You can add liquidity to pools for BANANA, TLOS, USDT, ETH, BTC, and USDC. You can stake your LP tokens to earn TLOS rewards. You can even buy discounted TLOS through the Treasury Bills feature, which lets you lock up your LP tokens for a set period and get TLOS at a lower price than market rate.

The fee structure is smart. Every trade on Telos costs 0.2%. That breaks down like this:

- 0.075% goes to buy back and burn BANANA tokens

- 0.0375% goes to the ApeSwap Treasury

- 0.0375% goes to the Telos network

- 0.05% goes straight to liquidity providers

That’s a solid model. Burn tokens to reduce supply. Reward LPs to keep liquidity flowing. Fund the project’s future. It’s the same system that works brilliantly on BSC. So why doesn’t it work here?

The Reality: No Liquidity, No Volume, No Users

Here’s the hard truth: ApeSwap on Telos has no users.

According to CoinGecko’s 2025 data, ApeSwap ranks 7th among Telos DEXs - and last in actual trading. The entire Telos DeFi ecosystem only sees $742 in daily volume across all platforms. That’s less than a single popular trade on Uniswap. Swapsicle V2, the top DEX on Telos, controls 64.6% of that tiny pie. ApeSwap? It’s not even on the map.

Look at the numbers:

- 24-hour trading volume: $0.00

- User reviews on DappBay: 0

- Rating: 0/5 stars

- Community mentions: Nearly nonexistent

There are no YouTube reviews focused on ApeSwap on Telos. No Reddit threads asking for help. No Twitter updates from users celebrating a big harvest. That’s not because people are quiet. It’s because nobody’s using it.

Compare that to ApeSwap on BSC, where daily volume regularly hits millions. Where users brag about 100%+ APR on farms. Where the community is active, loud, and growing. The same platform. Two completely different realities.

Why Does This Happen?

It’s not about the tech. ApeSwap’s interface is clean. The contracts are audited by Paladin. The tokenomics are sound. The problem is network effects.

DeFi doesn’t work in a vacuum. You need people trading. You need liquidity. You need competition. Without them, even the best features become useless.

Telos is a technically solid blockchain - fast, low-cost, eco-friendly. But it never caught on. Ethereum, BSC, and Polygon swallowed most of the DeFi market. Smaller chains like Telos, Arbitrum Nova, or Celo struggled to attract users. Why move your funds to a new chain when the old one already works? Why add liquidity to a pool with no buyers? Why stake your tokens if no one’s trading?

ApeSwap’s partnership with Telos in 2022 looked promising. The 12-month revenue-sharing deal was meant to boost adoption. But it didn’t work. The deal ended. No new incentives followed. The market moved on.

What You’d Actually Experience Using It

Let’s say you’re curious. You connect your wallet. You swap 100 USDT for BANANA. The trade goes through. No slippage? Maybe. But why? Because there’s almost no one else trading. The pool is shallow. Your $100 might be 10% of the entire liquidity.

Now you try to farm. You stake your BANANA-TLOS LP tokens. You see a 20% APR. Sounds good, right? But here’s the catch: the 0.05% fee from trades is what pays that APR. With $0 in volume, that fee is $0. Your reward? Probably just TLOS from a small, fixed pool - not from real trading activity.

And if you try to withdraw your LP tokens? You might find the price has dropped because no one’s buying. That’s slippage in reverse.

You’ll also need TLOS tokens to pay for gas. You’ll have to bridge your BANANA from BSC to Telos. That costs money. That takes time. And for what? To earn almost nothing?

Who Should Even Try This?

Only three types of people should consider ApeSwap on Telos:

- Early Telos believers - If you think Telos will explode in 2026 and you’re willing to take a long-term bet, you might add a small amount of liquidity now. But don’t expect returns. Think of it as seeding a garden, not harvesting crops.

- Token holders looking to use BANANA on Telos - If you already own BANANA and want to use it on Telos for some reason (maybe you’re building a dApp), then sure. But you’re not here for yield. You’re here for utility.

- Researchers or developers - If you’re studying how DeFi protocols fail on niche chains, this is a textbook case. Learn from it. Don’t invest in it.

Everyone else? Stick to ApeSwap on BSC, or better yet, try platforms with real volume like Uniswap, PancakeSwap, or Curve. They’re not perfect. But at least they’re alive.

The Bigger Lesson

ApeSwap on Telos isn’t a bad product. It’s a warning.

Many crypto projects assume that if they build it, users will come. But that’s not how DeFi works. You don’t just need a good interface. You need liquidity. You need users. You need a critical mass.

Platforms like ApeSwap, SushiSwap, and Curve all started on Ethereum. They moved to BSC because that’s where the money was. They didn’t try to build on 10 chains at once. They picked the ones with the most users - and then doubled down.

Telos didn’t get that critical mass. And now, ApeSwap’s presence there is just a monument to a failed bet.

If you’re looking for yield, go where the volume is. Don’t chase novelty. Don’t fall for the hype of "multi-chain" unless you can see real numbers behind it. ApeSwap on Telos looks great on paper. In practice? It’s a ghost.

What’s Next for ApeSwap and Telos?

Right now, there’s no sign of a turnaround. No major partnerships. No airdrops. No marketing push. The Telos ecosystem hasn’t seen a major DeFi upgrade since 2023. ApeSwap hasn’t announced any new features for Telos since the revenue-sharing deal ended.

Unless something changes - like a big exchange listing TLOS, a major game launching on Telos, or a cross-chain bridge bringing in users from Ethereum - this will stay dead.

For now, ApeSwap’s future is on BSC, Polygon, and maybe Solana. Not Telos.

Final Verdict

ApeSwap on Telos is a technically sound DeFi platform that no one uses. It has all the features you’d expect - swaps, farms, staking, Treasury Bills - but zero volume, zero users, and zero rewards.

Don’t avoid it because it’s risky. Avoid it because it’s pointless.

If you’re looking to trade, farm, or stake - go elsewhere. ApeSwap’s real power is on other chains. On Telos, it’s just a relic of a failed expansion.